All Categories

Featured

Table of Contents

That usually makes them a more cost effective option forever insurance policy coverage. Some term policies may not keep the premium and death profit the same gradually. Term life insurance with accidental death benefit. You don't want to erroneously think you're buying level term insurance coverage and then have your survivor benefit modification in the future. Numerous individuals obtain life insurance policy coverage to aid economically shield their liked ones in instance of their unanticipated fatality.

Or you may have the option to transform your existing term insurance coverage into a permanent plan that lasts the rest of your life. Numerous life insurance policy policies have potential advantages and disadvantages, so it is essential to recognize each before you determine to purchase a policy. There are several benefits of term life insurance, making it a prominent selection for coverage.

As long as you pay the costs, your beneficiaries will get the death benefit if you pass away while covered. That claimed, it is very important to note that most plans are contestable for two years which means protection can be retracted on death, should a misrepresentation be found in the application. Plans that are not contestable often have actually a graded fatality advantage.

What is Term Life Insurance Level Term and Why Is It Important?

Premiums are usually lower than entire life plans. You're not secured into an agreement for the rest of your life.

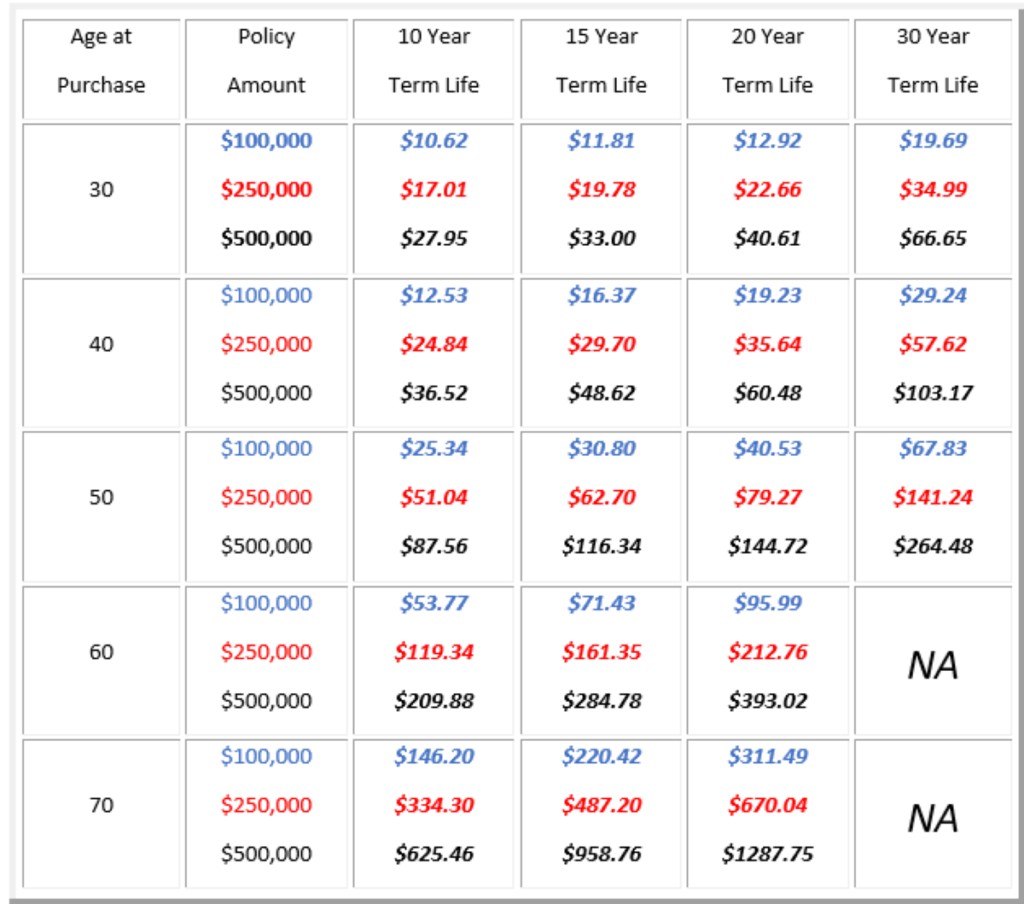

And you can not cash out your policy during its term, so you will not receive any economic take advantage of your past coverage. As with various other kinds of life insurance, the cost of a level term plan relies on your age, insurance coverage demands, employment, way of life and health and wellness. Usually, you'll find much more inexpensive coverage if you're younger, healthier and much less high-risk to insure.

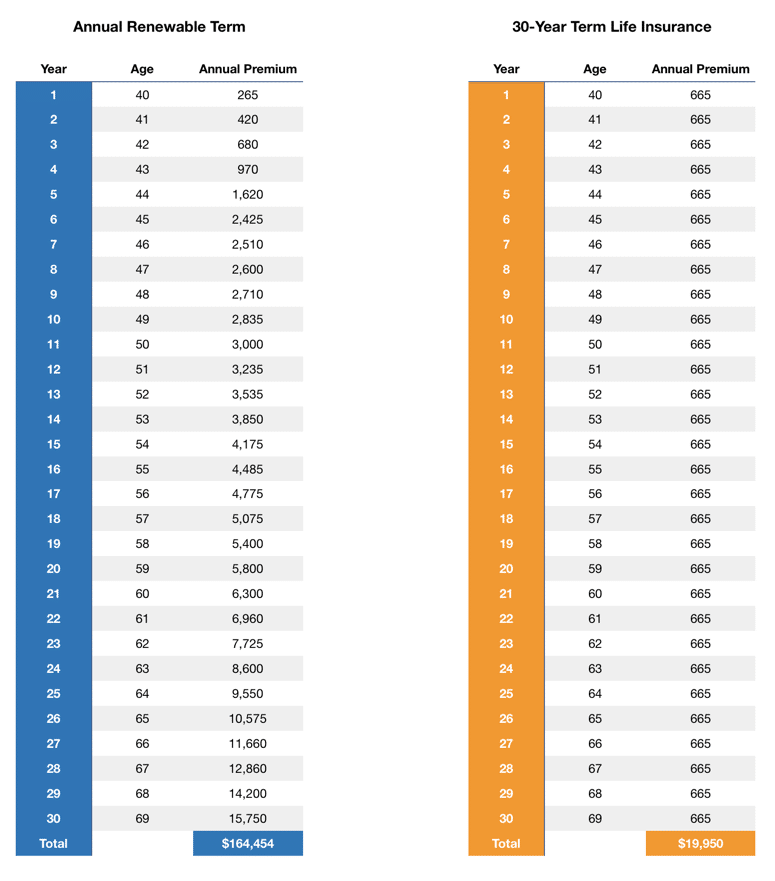

Considering that level term premiums stay the same for the duration of protection, you'll recognize precisely how much you'll pay each time. Level term coverage likewise has some versatility, permitting you to tailor your policy with added features.

What is Term Life Insurance For Seniors? Key Considerations?

You may have to meet details conditions and qualifications for your insurance provider to enact this motorcyclist. On top of that, there may be a waiting period of approximately 6 months before taking result. There additionally could be an age or time frame on the coverage. You can include a kid biker to your life insurance policy plan so it additionally covers your children.

The death benefit is generally smaller sized, and coverage typically lasts till your kid turns 18 or 25. This cyclist may be an extra affordable means to aid ensure your kids are covered as cyclists can typically cover several dependents at the same time. As soon as your kid ages out of this insurance coverage, it may be feasible to transform the biker into a new policy.

The most common type of long-term life insurance is entire life insurance policy, yet it has some vital distinctions contrasted to degree term protection. Here's a standard introduction of what to consider when contrasting term vs.

The Benefits of Choosing Simplified Term Life Insurance

Whole life insurance lasts insurance coverage life, while term coverage lasts protection a specific periodDetails The premiums for term life insurance policy are generally reduced than entire life protection.

One of the highlights of degree term coverage is that your premiums and your fatality advantage do not transform. With decreasing term life insurance coverage, your costs stay the exact same; nevertheless, the survivor benefit quantity gets smaller in time. You may have protection that begins with a fatality advantage of $10,000, which can cover a home loan, and then each year, the death benefit will reduce by a set amount or percentage.

Because of this, it's typically a more budget-friendly sort of level term insurance coverage. You might have life insurance policy through your employer, however it might not suffice life insurance policy for your requirements. The initial step when purchasing a plan is determining how much life insurance policy you need. Consider variables such as: Age Household size and ages Employment status Income Financial debt Way of living Expected last expenditures A life insurance policy calculator can assist figure out just how much you require to begin.

What is Term Life Insurance For Spouse and Why Does It Matter?

After determining on a plan, finish the application. If you're approved, sign the paperwork and pay your initial premium.

You might desire to upgrade your beneficiary information if you have actually had any significant life modifications, such as a marriage, birth or divorce. Life insurance can in some cases feel complicated.

No, level term life insurance policy doesn't have cash worth. Some life insurance policy plans have an investment attribute that enables you to construct cash value in time. A portion of your premium settlements is reserved and can make passion with time, which expands tax-deferred during the life of your insurance coverage.

These plans are commonly considerably extra expensive than term coverage. If you get to completion of your plan and are still to life, the coverage ends. You have some alternatives if you still want some life insurance policy protection. You can: If you're 65 and your coverage has actually run out, for instance, you might desire to purchase a new 10-year degree term life insurance policy.

What is What Is Level Term Life Insurance? Understanding Its Purpose?

You might have the ability to transform your term coverage right into a whole life plan that will last for the remainder of your life. Numerous sorts of degree term plans are convertible. That suggests, at the end of your insurance coverage, you can convert some or all of your plan to whole life insurance coverage.

A level costs term life insurance strategy lets you stick to your budget plan while you help safeguard your household. ___ Aon Insurance Coverage Providers is the brand name for the brokerage and program administration procedures of Fondness Insurance Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Company, Inc. (CA 0795465); in Alright, AIS Affinity Insurance Coverage Solutions Inc.; in CA, Aon Affinity Insurance Policy Providers, Inc .

Latest Posts

Final Expense Vs Whole Life

Seniors Funeral Cover

Funeral Coverage